TFDF Community Spotlight: Money Machine Newsletter

😳 Hackers' 1% Edge on Stocks

Hey All,

I am trying something new - spotlighting fellow Substackers creating exceptional content.

Meet Money Machine Newsletter—work I admire and think you will too.

It’s designed to help you become a smarter, independent investor with two things:

Market-beating stocks in a 5-min read. Picked by elite traders. Delivered weekly to your inbox pre-market.

Market, investing, and business insights from insiders and experts outside the mainstream media.

You won’t find the same watered down stock picks or mainstream media information here.

I’ll let Money Machine Newsletter take it from here…

This week’s market, investing, and business insights from insiders and experts outside the mainstream media:

Hackers’ 1% edge on stocks and their toughest challenge.

There’s a lurking danger for the stock market.

From incinerating cash to printing cash... THIS company nailed it.

Tanking EA stock with “the worst game in history.”

And more. Let’s get to it!

Top Insights of the Week

1. 😳 Hackers' 1% Edge on Stocks

Hackers can steal billions in bitcoin, breach a country’s defense system, and access millions of social security numbers... but they met their most difficult challenge... it has nothing to do with code... it’s being fooled by randomness...

Hackers breached press-release systems to trade stocks before the news went public, the catch?… sifting through the noise. Most press releases were useless. They threw out 99% of them… the 1% they kept?… merger announcements.

Their hit rate? 70%. Enough to make hundreds of millions before getting caught, insider trading at its finest… you know, what politicians do. But, let’s face it, we're not all Nancy Pelosi or hackers… but still, curious to know what happens if traders also had access to next day's news… that's what Victor Haghani (ex-Long-Term Capital Management partner) and James White (CEO of Elm Partners) tested, their findings…

Even with tomorrow’s news, traders were only right 51%… barely better than a coin toss.

Overconfidence destroyed portfolios… big bets on bad ideas wiped out 16% of participants.

Top traders improved to just 57% accuracy.

What separated winners from losers? strategy…

Top traders passed on 1 in 3 trades they weren’t sure about.

Small, smart bets beat big gambles EVERY TIME.

Over leveraging on “sure things” destroyed portfolios.

"He who lives by the crystal ball will die eating shattered glass." Ray Dalio out here spitting facts. Investing doesn’t require a crystal ball… it requires clear thinking, filtering out noise, and seizing small, consistent edges… you don’t need tomorrow’s news to win… you just need a better way to play.

2. 👊 Everyone Is Bullish… Until They Get Punched in the Face

“God Himself couldn’t sink this ship!” damn, that’s BOLD… that’s what they said about the Titanic… gulp… crazy part, the iceberg wasn’t the main culprit here… a rare weather event—thermal inversion—bent light (creating a mirage), hid the iceberg, and delayed rescue efforts… it was a snowball effect of small things... hate to say it, but the stock market might be facing its own thermal inversion right now…

Stock market looks unstoppable right now, but danger is lurking... Americans have 54% of their wealth in stocks—higher than the Dot-Com Bubble—while bonds and cash lag at 18% and 9%.

What’s going on…

Low interest rates and easy money pushed investors from cash and bonds to stocks as inflation surged.

Markets channeling Neo from the Matrix, dodging crashes and recessions has boosted investors’ confidence.

Trading has doubled since 2000, fueling a cycle… more trading creates bigger swings, and bigger swings draw more trading.

What does this mean…

More IG posts of people in Ferrari’s and private jet planes, with the hashtag #WeGotMoneyPlaya… well… that’s part of it… rising stocks make people feel rich, so they spend more, fueling 70% of the economy… but a crash could wipe out wealth and ripple through everything.

Stay ready…

Become a premium subscriber with Money Machine Newsletter today... no matter how the market moves—up or down—we read the markets, make money when it's available, and PROTECT capital when we need to.

3. 💸 From Incinerating Cash to Cash Flow

Few people think you can go from incinerating cash to suddenly flipping the money PRINTING switch... and we agree... but there’s always the exception to the rule... and we think this particular company nailed it… Uber…

Going from big losses to steady profits, $2.6B net income in Q3 2024.

Now in 70+ countries, it’s resilient to slowdowns and ahead of competitors in growth.

This insane shift makes it stand out…

Leads ride-hailing and delivery with a strong brand recognition.

Cost cuts and price optimizations are lifting margins, setting up long-term growth.

Ride-hailing and delivery could hit ~$800B by 2030, leaving Uber plenty of room to grow.

A few products they’re moving in the shadows…

Testing financial services (payments, savings) and combining other transport options (bikes, scooters, flying cars) to become a one-stop app, like WeChat in China.

Uber Freight trims the fat and inefficiency in logistics.

Launching autonomous rides with Waymo in 2025.

Top 3 Charts of the Week

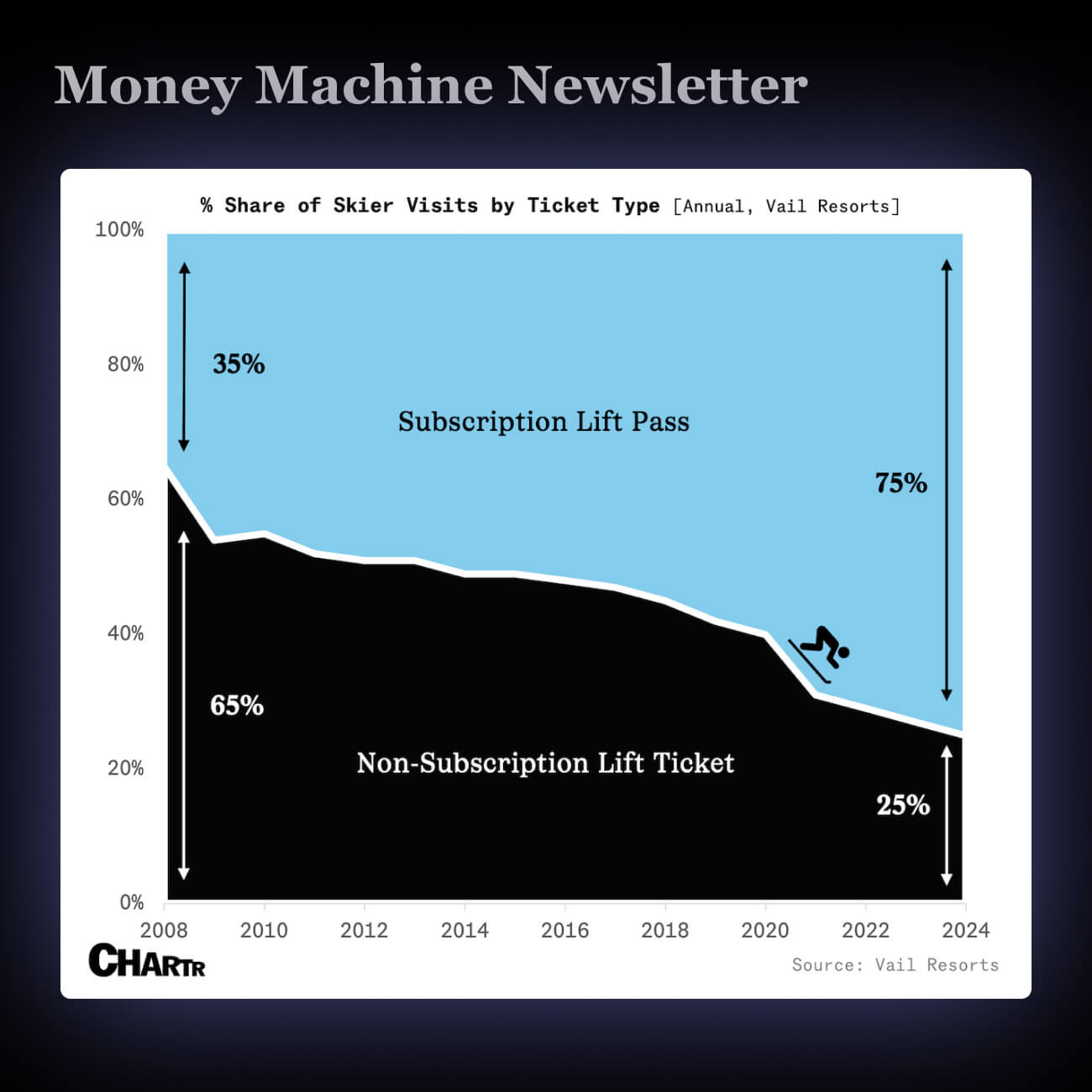

1. 🎿 Vail Resorts Turns Into a Subscription Business

Vail Resorts reported fewer skier visits (down 0.3%) and a 2% drop in sales of its Epic Pass, a key subscription product accounting for 75% of visits.

Pricey lift tickets ($300/day) and Epic Pass reliance are pushing skiers away, while competitors like Ikon Pass gain traction. Revenue rose slightly, but the stock dropped 21% in a year.

2. 📈 Netflix Hits Record-Breaking Subscriber Growth

Netflix added a record 18.9M subscribers, reaching over 300M paid memberships. Revenue hit $10.25B, and net profit was $1.9B, fueled by live sports and holiday hits.

Netflix had its best quarter ever, but it’s shifting focus away from subscriber numbers. Price hikes ($17.99 for the standard plan) may test user loyalty as growth slows.

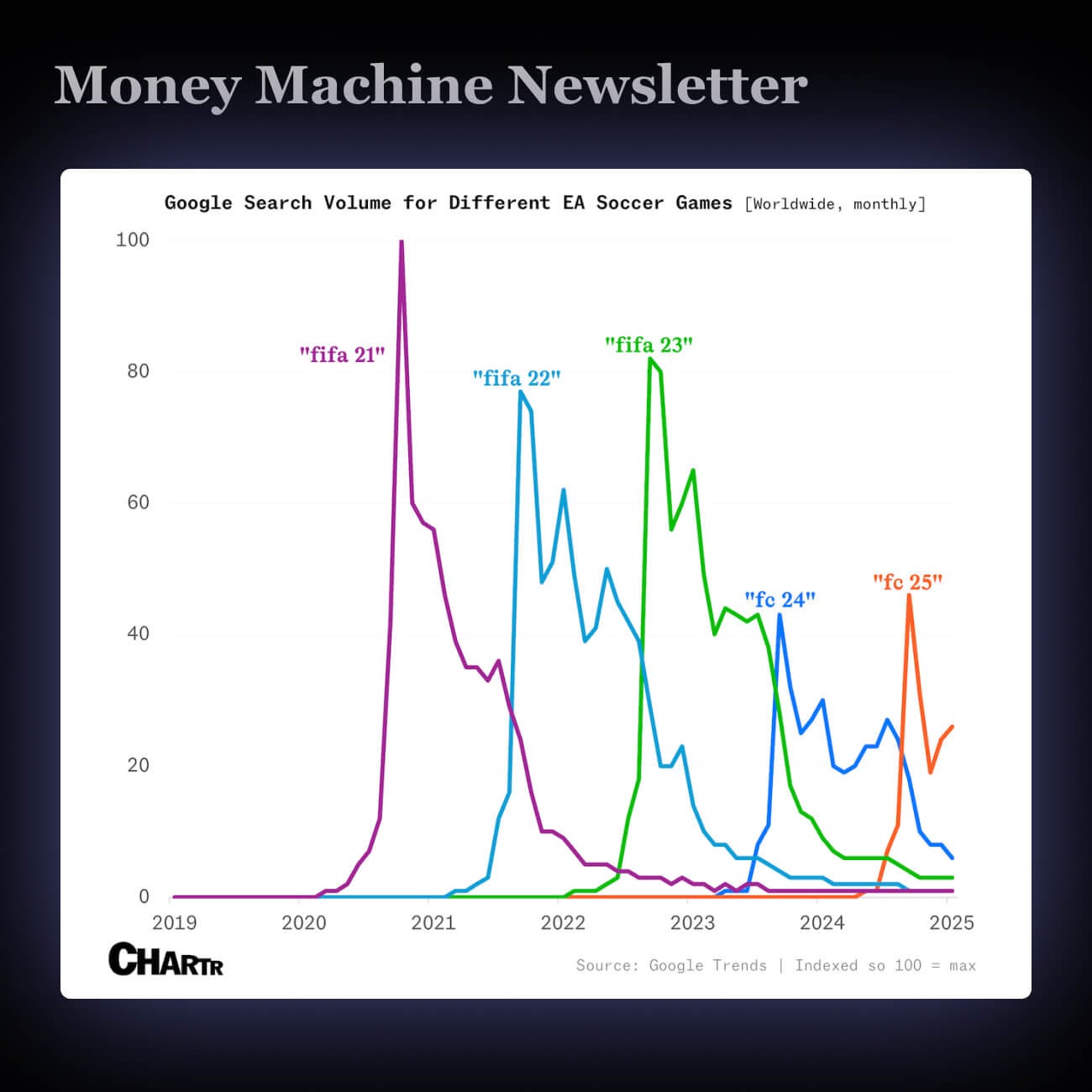

3. ⚽️ EA's FIFA Rebrand: A Risk That Missed the Goal

EA stock dropped 17% as sales for its FIFA-rebranded game, "EA FC 25," and "Dragon Age" fell short. Full-year revenue forecasts were cut to $7–7.15B, down from $7.5–7.8B.

Losing the FIFA name hurt EA’s soccer game sales, which heavily support its "Live Services" revenue—over 70% of EA’s total income. Fans are upset, calling the latest version "the worst game in history."

If you’re ready to get serious about investing, then join 6,000+ people who have already placed themselves on the path to greater wealth by making $500, $1,000, $2,000, $3,000, or more every month with Money Machine Newsletter’s trade ideas.

See you in there!

Best,

Money Machine Newsletter

That’s an interesting breakdown! The hackers’ 1% edge on stocks is wild. It really highlights how much strategy can matter in investing. I love how they emphasize small, smart bets over big risks. As for Uber, it’s crazy how they’ve flipped things around. What do you think of their future with those new ventures?

Max, I gave you a dm, let’s connect!!